Abstract

- BNPL is fast and simple, however lenders face dangers because of rising quantities spent and the necessity for quick analysis — $176B is anticipated to extend.

- BNPL functions contain intensive background processes corresponding to ID checks, facial recognition, machine danger, and checking account verification.

- Your information is utilized for BNPL functions however shouldn’t be a priority if used responsibly; corporations will possible supply offers primarily based on shopping for patterns.

Buy now, pay later (BNPL) is nice. It solely takes a minute to arrange your account on the app, and there you go. You possibly can afford the great stuff you need, as a result of you’ll be able to pay for it over 4 months. So long as you retain up the funds, it’s an easy, interest-free loan. That is true.

BNPL is also great, and because it is so quick, you are solely dipping your toe within the credit score swimming pool. No one is aware of you are doing it, and so long as you pay on time, no person cares. The deal is between you and the app, and it stops there. Proper? Nope, flawed.

The second you begin speaking to the app, you go into the system. And also you keep there. Let me inform you what occurs in that minute it takes to open a BNPL account.

This isn’t about knocking BNPL or the individuals who use it to purchase what they need when cash is brief proper then. It’s also not in regards to the Fintech corporations behind the apps you’d use to open an account, or the credit score bureaus they use to confirm your particulars through the utility. I’m merely explaining that you’re not simply dipping your toe in, you might be diving head-first into the water. By the point you could have your BNPL account, your particulars have been world wide, have been checked out, analyzed, run via a number of databases, and added to a couple extra. No one will actually mess along with your particulars. I am simply telling you to present you all of the tremendous print.

Why BNPL is so fast

Small quantities, low danger?

Most customers assume, as a result of BNPL includes small quantities over a short while, the danger is low, and that’s the reason the method is so fast. The fact is that for the lenders, the danger lies within the $176 billion {dollars} at the moment spent on BNPL, and the collective risky behavior of the whole variety of individuals utilizing these loans.

Saying sure to large commerce

The $176 billion spent on BNPL is anticipated to balloon to $380 billion in 2030, and that is simply an excessive amount of cash to say no to. However 10% unhealthy debt of $176 billion immediately is $17.6 billion, so the trick is to guage new BNPL purchasers completely to deliver the danger down. However the valuation has to occur in a short time, in any other case these prospects are one click on and gone.

Friction and the necessity for velocity

Most BNPL transactions — 70 to 80% — occur on-line, and on-line is the wild west in retail phrases. If the fintechs doing the BNPL functions might take their time, they might. However something longer than a minute or two is just too lengthy, and the client will click on away to another person.

The 90% of excellent debt within the instance above is $158 billion, and who will let that slip via their fingers? The effort and time it takes to transact on-line is named friction within the commerce, and the quantity of friction a web based shopper is keen to tolerate may be very low. One click on.

How BNPL occurs so rapidly

All of sudden, all within the background

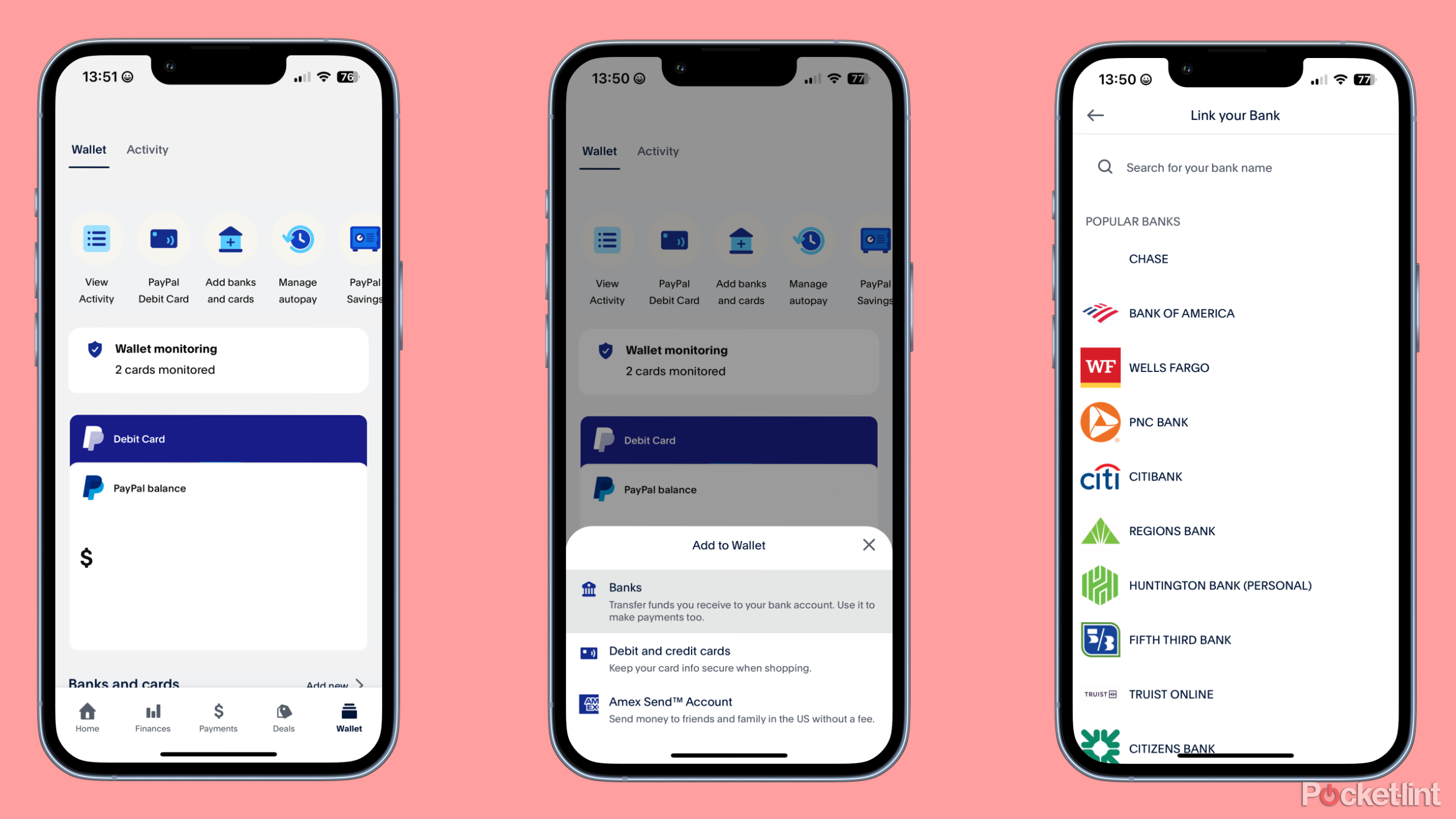

Whenever you apply for BNPL, it’s a must to present ID, a driver’s license or passport, in addition to a bank card or checking account particulars. You could be requested for a selfie the place you do one thing like contact your ear, however that’s simply to protect towards deep fakes. The remainder of the stuff occurs concurrently, in a short time, and within the background. You will not even find out about it, except your particulars get flagged.

Identification doc

An optical character reader is used to extract all the knowledge from the identification doc you present and that is run towards huge identification databases. It would instantly decide up in case you are you, and if in case you have been naughty or good. If good, you’ll go on a brand new database for BNPL candidates whose ID checks out. Information is gold, and so they by no means throw something away.

The data on the datasets may also be used to prefill your utility type to scale back handbook errors and velocity up the method.

Identification picture

No one seems to be like their driver’s license image, however facial recognition measures your facial options and the dimensions, distance, and relationship between your eyes, or eyes and ears and nostril. The ensuing digital compilation identifies your facial options as uniquely as a fingerprint, and this digital ‘faceprint’ is distributed via different databases to test for suspicious matches. If it is good, it is cool — however your face will nonetheless sit in a database of excellent faces.

System danger

All on-line transactions, together with BNPL functions, contain the usage of a tool — your cellphone, pill, or pc. Every machine has a novel signature, and no, anonymous VPNs is not going to work. Your machine will probably be recognized and run via extra databases and different diagnostics to test if it has ever been stolen, concerned in fraud or unlawful actions, unhealthy loans, or crimes like cash laundering.

Adjustments corresponding to SIM swapping will probably be picked up, and your geolocation will probably be verified. As soon as verified, your machine will be a part of your identification on a database within the cloud someplace.

Checking account

Your banking particulars will probably be verified to ensure they’re linked to your identification. Whereas they’re at it, it’s going to most definitely even be run via different databases to test for suspicious transactions, different financial institution accounts linked to your ID, and so forth.

Different accounts and loans

BNPL is at the moment seen as a smooth credit score test, which suggests it will not have an effect on your credit score document as issues stand. That can most likely change later within the yr, however your particulars will nonetheless be run via the BNPL datasets to see what number of different such loans you at the moment have and the way these might have an effect on the affordability of your utility.

No want to fret but

Your information is on the market, anyway

If you happen to plan on staying financially sound and on the suitable facet of the legislation, not one of the stuff described above ought to concern you. Credit score bureaus are discreet and can most likely not promote your information. The fintechs who run the BNPL apps will use your information and shopping for patterns to tell you of offers you’ll be able to make the most of, however that is described on their web sites, and you’ll most likely choose out if you want.

Utilizing BNPL

So long as you employ BNPL responsibly, it is a great way to purchase items that may in any other case be past your funds. The businesses concerned are usually pretty accountable of their actions, though they may most likely encourage you to spend extra in the event that they assume your funds can deal with it. So keep sensible, be protected. A little bit little bit of paranoia shouldn’t be essentially a foul factor.

Trending Merchandise

Sceptre Curved 24-inch Gaming Monitor 10...

SAMSUNG FT45 Sequence 24-Inch FHD 1080p ...

Sceptre Curved 24.5-inch Gaming Monitor ...

SAMSUNG 27-Inch S43GC Series Business Es...

ASUS Vivobook Go 15.6” FHD Laptop comp...